A Beginner's Guide To Understanding Restaurant Financial Statements for the Non-Accountant

The Rezku Team

If you’re running a restaurant or plan to open one, you need to be able to read the four basic financial statements used in all businesses. This simplified guide will teach you:

- What each of the financial statements are.

- Why they are important information about the business.

- How to read and interpret the statements.

- How each of the statements are calculated.

Accounting can be a complected subject, but don’t worry. In this simplified, beginner’s guide we will only touch lightly on accounting concepts.

We highly recommend that every novice restaurateur hires a professional bookkeeper or accountant to manage their books. However, even with professional assistance, understanding restaurant financial statements is a key aspect of your leadership role and being able to make informed business decisions.

What are restaurant financial statements?

Financial statements are a special class of business reports that show the overall financial picture of the business. They are a formal record of your business’s financial activity.

Financial statements are extremely important to owners, partners and lenders because they reveal the current status and health of the company.

The 4 Basic Financial Statements Every Restaurateur Needs to understand:

One of the most confusing things for beginners is that many of the reports go by multiple names. Here, we list them all.

- Profit and Loss Statement

- P&L

- Income Statement

- Revenue Statement

- Earnings Statement

- Operations Statement

- Performance Statement

- Balance Sheet

- Statement of Financial Position

- Statement of Assets and Liabilities

- Cash Flow Statement

- Statement of Cash Flows

- Changes in Equity Statement

- Statement of Owner’s Equity

- Statement of Retained Earnings

- Statement of Changes in Equity

Statement Reporting Periods

Restaurant financial statements can be generated for different reporting periods.

Quarterly Statements

The P&L, Balance Sheet and Cash Flow Statement are completed every three months or four times a year. That’s why they are called “quarterly reports.”

Quarterly financial statements contain financial data for the business during each three-month period. You may hear people refer to these three month periods of the year as Q1, Q2, etc.

Annual Reports

Annual versions of the P&L, Balance Sheet and Cash Flow Statement will also be generated for the business. Annual reports come out in Q4 and use data for the whole year as the reporting period.

Eventually you will compare financial statements from multiple years to see how the restaurant’s financial health evolves.

Using the annual financial statements, you’ll see if you had a “good year” or a “bad year” and monitor the rate of growth (or loss) over the life of the business.

How Each Financial Statement Works

Next we’ll look at each financial statement in detail. You’ll learn how to read a financial statement and how to complete your own.

So we don’t have to detour into accounting to much, please note that for the sake of clarity, our examples will use the simpler cash method of accounting rather than the accrual method, which is the standard for business accounting.

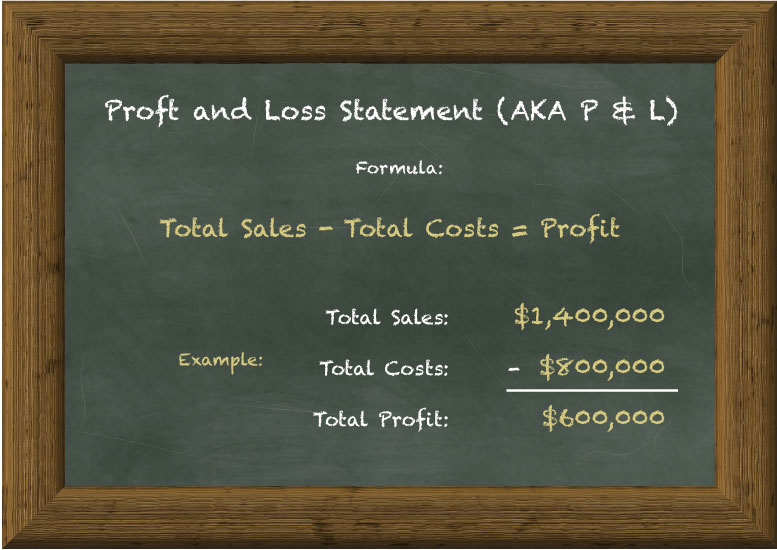

The P&L Report

A “P and L” is the profit and loss statement. It uses a very simple formula that tells you how much money you’ve got left after taking into account all the costs associated with the business.

It is Total Sales, minus Total Costs. The remainder is Profit.

Though it’s simple in concept, this may be the most important report in your entire business. After all, a business is designed to make money.

P&L Terminology

P&L report terminology is bit interchangeable. So, when you’re initially learning it can seem a lot more confusing than it really is.

- A P&L may be referred to as an “Income Statement”.

- “Sales” can also be referred to as “Income” or “Revenue”.

- “Costs” may be listed on a P&L as “Expenses” or “Losses”.

- “Profits” can also be called “Net Income”.

Keep this cheat sheet handy while learning and it will all become much easier.

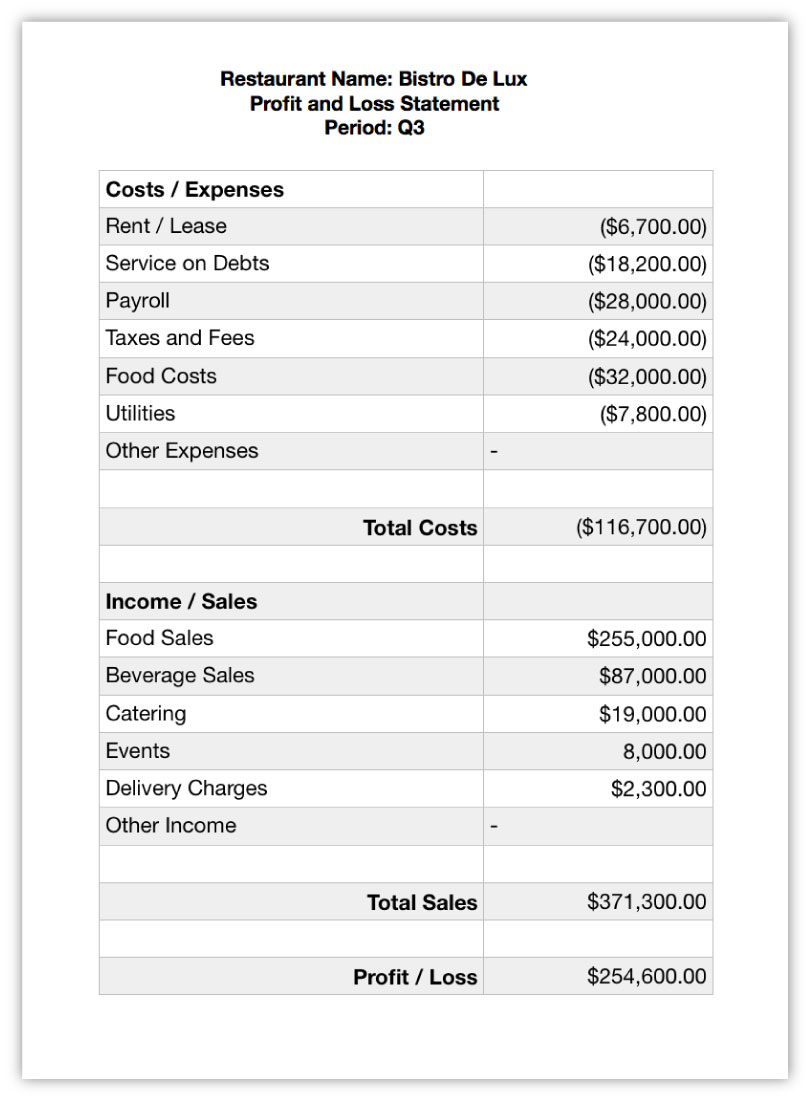

When you’re reading a P&L, Sales and Costs will be broken up into meaningful sub-categories. For example, it would make sense to group Sales by channel (Dine-in, Online, Takeout, Delivery) and to sort Costs by type (food costs, packaging costs, utilities, rent, etc.)

Example Profit and Loss Statement:

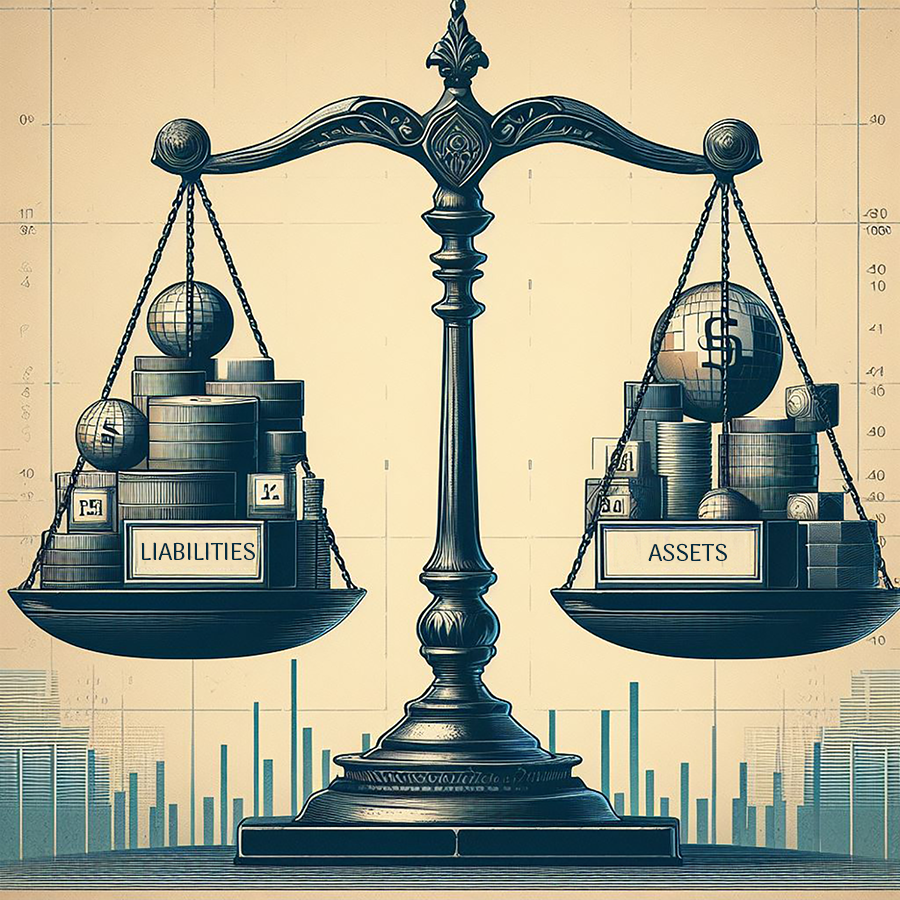

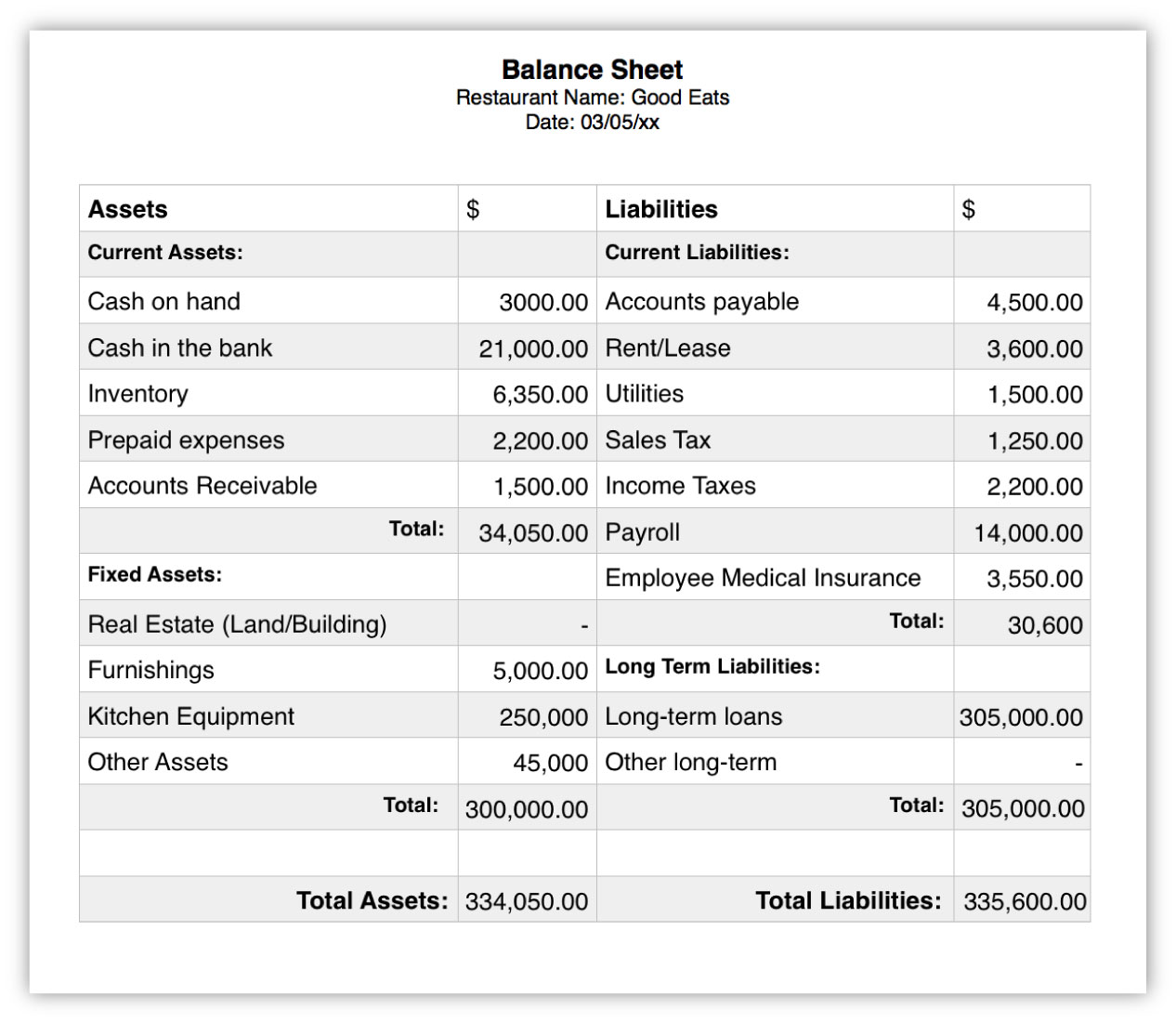

The Balance Sheet

A balance sheet is used to show the net worth of the restaurant. You can think of a balance sheet as a set of scales showing Liabilities on one side and Assets on the other. They show the balance – which is where we get the name from.

The purpose of the Balance Sheet is to see which way the “scale” is tilted. That is, if you’re losing money, making money or breaking even.

Balance Sheet Terminology

Some terms for the balance sheet are also used interchangeably. Keep this in mind when learning about balance sheets so you don’t get confused.

Another name for “Liabilities” is “Debt”. Let’s take the debt example of a loan.

-

The amount owed on the loan amount will be recorded in the Liabilities column of the balance sheet.

-

However, the amount received (what was given to you by the bank) is recorded as an Asset.

Together, these two amounts balance each other out, and this is actually the principle behind double accounting also known as the accrual method.

Keep in mind that this is a simple example and it’s not always the case that the two columns are equal.

Asset Categories

It’s worth mentioning the different types of assets at this point.

-

Current assets – These are assets that can be converted into cash within a year. They will be listed under “Cash”, “Accounts Receivable”, or “Inventory”.

-

Fixed Assets – These are long-term assets not easily convertible into cash, such as; equipment, furnishings, and buildings.

Even if you’re still paying off a loan for these, they are still listed under Assets. The remaining amount owed is listed under Liabilities.

Liability categories

Liabilities also fall into two categories.

-

Current Liabilities – These are obligations due within one year. For example, the amount paid on loans, taxes, rent, payroll and food costs this year.

-

Long Term Liabilities – Obligations due after one year are listed here. For example, the unpaid amounts for multi-year loans and lease agreements.

Balance Sheet Formula

Here is how a balance sheet is constructed:

- List all Assets in Column One.

- List all Liabilities in Column Two

- Subtract Liabilities from Assets

What the difference between Assets and Liabilities is the restaurant’s Net Worth.

If Net Worth is a negative value, that means your restaurant owes more than it’s currently worth.

If you are just starting out, there will likely be a period where net worth is negative. The nature of business is that it takes a initial large capital investment. For restaurants it may be years before it breaks even.

However, if you’ve been in business for many years and liabilities continue grow, you’re in a tricky situation. This is a key indicator that changes must be made.

Example of a Restaurant Balance Sheet:

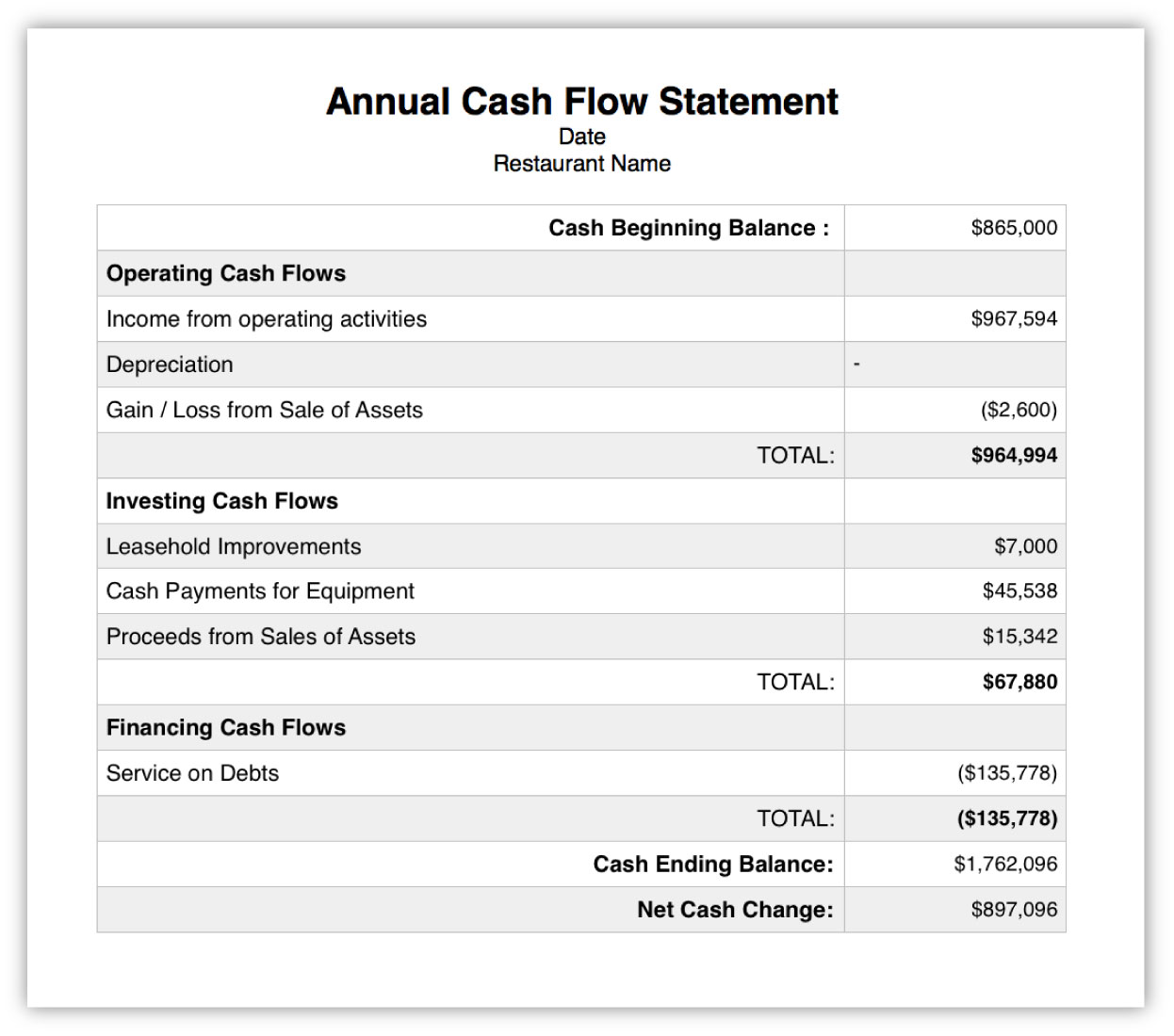

The Cash Flow Statement

Like the name implies, the Cash Flow Statement is used to get a snapshot of the flow of on cash in and out of a business. Regardless if a restaurant appears profitable or not on paper, the key to staying afloat is cash flow. Cash is the logs in the fire that keeps everything going.

Cash Flow Statement Terminology

Like the other reports, one of the challenges with learning is the use of multiple terms to describe the same concepts.

-

Cash coming into the business is called Inflow, and is also referred to as “cash in”.

-

Money going out of the business is Outflow, and is also called “cash out”.

It is important to note that because the cash flow statement is a snapshot of cash entering and leaving the business, there are a lot of assets and liabilities that are not factored into the report. It’s all about what’s happening now.

-

Accounts receivable (sales made on credit) are not counted as cash in, until they are actually paid.

-

Debts that the restaurant owes are only recorded as the bills that are paid. Total debt is not recorded in the cash flow statement.

-

Assets that are already paid off are not recorded unless they are sold and payment is received within the period of reporting.

So what is recorded in the Cash Flow Statement?

There are three types of activity recorded in the Cash Flow Statement: * Operational activity (sales, bills etc.) * Investment activity (buying and selling of long term assets) * Changes in debt/financing (getting a cash influx from a loan or investor)

Most cash inflow and outflow recorded will be under operational activity, since these cash flows are core to daily operations.

Cash Flow Statement Formula

Here is how to construct a Cash Flow Statement:

1. The starting point for the cash flow statement is the restaurant’s Net Cash at the beginning of the reporting period. You’ll have this number from completing the balance sheet.

2. Now add lines for each of the restaurant’s cash inflows: * Sales of food, drinks, merchandise, and other services your restaurant provides. Including delivery charges, event hosting, etc.

3. Record investment inflows from sales of any long-term assets. * Eg.,You sold your old catering truck for cash on the spot.

4. Record debt/financing inflows. * Eg. Cash received from a short term loan for $5,000

This is your total cash inflow for the period.

Next, we’ll record totals for the following outflows:

5. Record operational cash outflows (also called receipts) * Payroll, food purchases, to-go container purchases, rent payments, repairs for delivery vehicles, etc.

6. Record investment outflows * Costs of purchasing new equipment.

7. Record debt outflows * Making payments on loans.

This is your total cash outflow for the period.

Now here’s where it gets interesting…

8. Minus total cash outflow from total cash inflow to get the Ending Cash value.

9. Compare Ending Cash to Beginning Cash to get the Net Cash Change

10. Net Cash Change is the final number that represents the restaurant’s cash flow for the recorded period.

Note that Ending Cash for this period will be the value for Beginning Cash for the subsequent period.

When looking at a cash flow statement it is important that the restaurant isn’t burning more cash than it is taking in. Otherwise, you’ll need to continue getting loans or liquidating assets just to keep covering your monthly costs.

Here is an example Cash Flow statement:

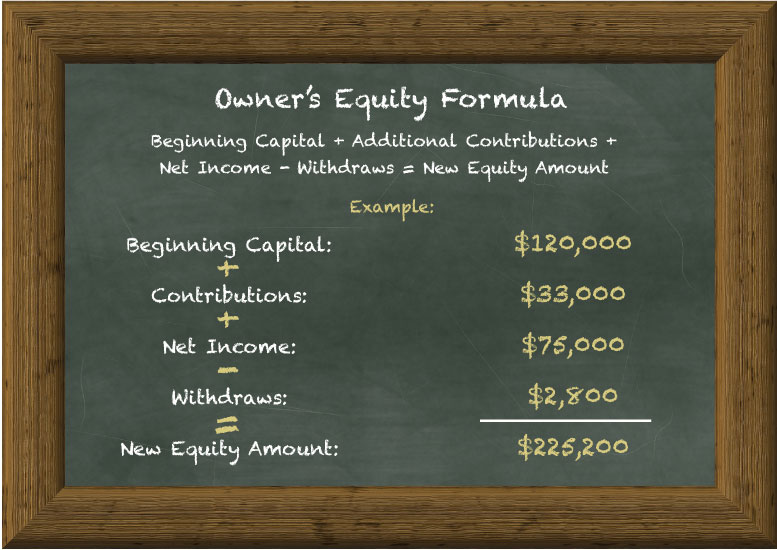

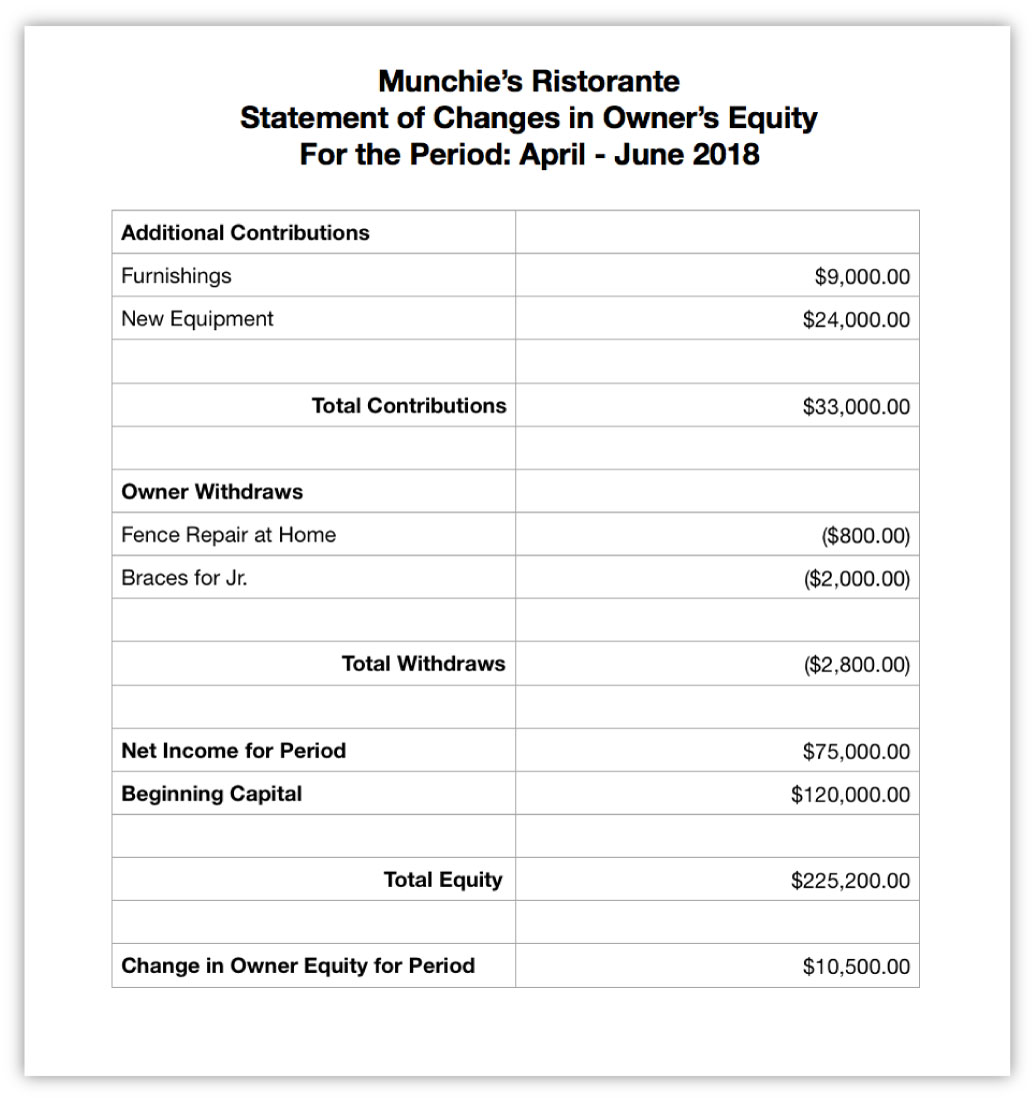

Changes in Equity Statement

The Changes in Equity Statement is also called the Statement of Owner’s Equity. It is a way of measuring contributions and withdraws in the business.

This applies whether there is a single owner or multiple partners.

This report also records if there is an increase or decrease in the overall value of the restaurant.

Changes In Equity Statement Terminology

-

Equity represents the owners’ stake or interest in the business. For a new restaurant, all of the initial equity will come from the capital invested by the owner(s) to start the business.

-

Retained Earnings are the total net profits that have been reinvested in the business and have not been distributed to owners.

-

The total owners’ stake at the start of the period, including initial invested capital plus any retained earnings from prior periods is the Beginning Equity.

-

Additional Capital Contributions are any new funds invested by the owners during the reporting period.

-

The total earnings generated by the business during the period is refereed to as Net income, Total Earnings or Total Profit.

The Changes in Equity Statement is designed to track the following:

- What the beginning equity is for each owner.

- Any additional capital contributions by any of the owners.

- The net income (total profit) generated by the business during the period.

- Any owner withdrawals of funds for personal use or repayment of personal loans to the business.

Changes in Equity Formula

1. Start with the beginning equity

2. Add any additional capital contributions by owner(s)

3. Add the net income of the restaurant for the period

4. Minus any owner withdrawals

The remainder is the Ending Equity.

5. The difference between Beginning Equity and Ending Equity is the Change in Equity

Example of Changes in Equity Statement:

Summary

In business, these four financial statements are put on a pedestal for a reason. With just these reports you can see the health and state of a business – if you know how to read them.

This beginner’s guide for the non-accountant defined these key documents in a simplified, easy to understand introduction.

If you are starting a restaurant, these reports will be an important part of your restaurant business plan.

If you’ve recently assumed a management role in a restaurant, you’ll be expected to keep track of business performance by examining these reports.

We hope you have gained value from this article. This free resource is brought to you by Rezku, a leading hospitality management systems developer.

Our mission is to help restaurant owners like you find greater success, through innovative and affordable restaurant management technology.

Contact Rezku today for a free consultation.

Call: 1-844-697-3958 x2

eMail: Sales@Rezku.com

Is Rezku the POS system you’ve been searching for?

Get a custom quote and start your free trial today.

Related Posts