Quick Service Restaurant (QSR) Industry: Market Size, Stats & Trends Report 2025

The Rezku Team

Quick Service Restaurant (QSR) Industry: Market Size, Stats & Trends Report 2025

The QSR industry in 2025 continues to evolve at a rapid pace, driven by shifting consumer behavior, technological innovation, and an increasingly competitive landscape.

What is a QSR? A quick service restaurant is a dining establishment characterized by its speed of service, affordability, and convenience.

As QSR operators navigate shifting consumer expectations and economic pressures, this report offers an in-depth look at the quick-service restaurant industry, covering market size, key statistics, and the trends shaping the rest of 2025 and beyond.

The Evolution of the QSR Industry

The QSR sector—named for “quick service restaurants—includes fast-food restaurants, coffee shops, and other counter-service concepts that focus on high volume and quick turnaround. The sector has rebounded strongly following the pandemic slowdown. In 2025, quick service restaurant trends focus on a blend of value, tech-driven convenience, and loyalty engagement.

Operators are moving beyond traditional models, with a clear shift toward improved experiences and personalization. This shift is driven by consumer demands for tailor-made orders, convenience, and health and wellness options, as well as the leveraging of technological advances, in response to intense competition and the growing demand for sustainability.

The following statistics are drawn from the National Restaurant Association’s State of the Restaurant Industry 2025 report, offering authoritative insights into the evolution of the QSR sector.

2025 Quick Service Restaurant Industry Trends & Stats

Quick service restaurant industry analysis has revealed the following trends and stats for 2025:

Economic Growth & Market Size

- The limited-service restaurant segment (which includes QSRs) is projected to hit $532 billion in sales in 2025, up from $510 billion in 2024—a 4.3% increase.

- Despite rising food and labor costs, over 80% of restaurant operators expect their 2025 sales to match or exceed 2024 levels. Specifically, 43% of QSR operators anticipate higher sales this year.

Value Still Drives Consumer Choices

- 66% of QSR operators plan to roll out new value deals in 2025.

- Combo meals, BOGO offers, and limited-time specials were among the most effective promotions in 2024 and are expected to remain popular.

- 75% of QSR customers say value promotions are important when choosing where to eat

Consumer Behavior & Demand

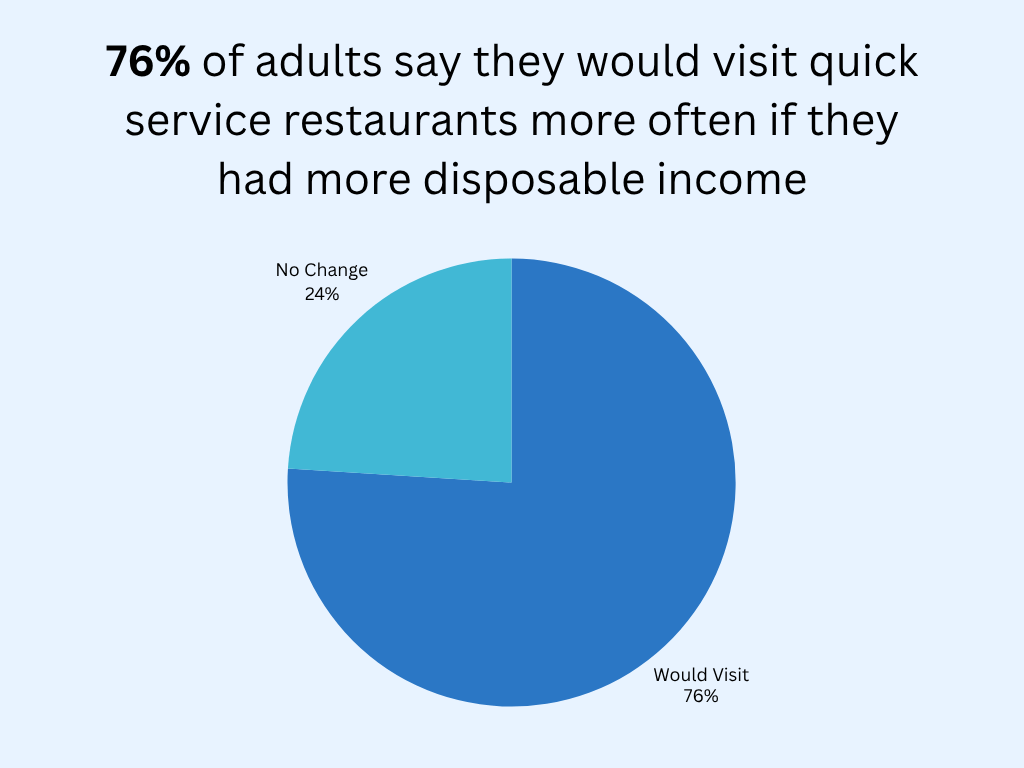

- 76% of adults say they would visit quick service restaurants more often if they had more disposable income.

- Gen Z and Millennials are the biggest fans of QSRs, valuing both speed and affordability.

- When ranking factors that influence the quality of their experience, 73% of QSR customers consider cleanliness to be more important than price.

Industry Statistics: QSR Economics

Quick service restaurant analytics reveal the following QSR industry economic statistics:

- QSRs make up the largest segment of the restaurant industry by volume, contributing to nearly 35% of total foodservice sales in 2025.

- The industry is expected to add 200,000 new jobs in 2025.

- Notably, 35% of QSR operators plan to open new locations this year, compared to just 22% of full-service operators.

- QSR operators cite food costs (18%), labor (14%), and employee retention (16%) as their top concerns in 2025. Inflation and operational costs remain high.

Key Takeaways for Industry Economics

- The QSR industry is on pace for $532B in revenue in 2025.

- Despite inflation, consumer demand is still strong.

- Labor and food costs remain the largest operational challenges.

- QSR business expansion is heating up, with many brands looking to grow their footprints.

Industry Statistics: Consumer Preferences & Experience

Statistics relating to what QSR consumers prefer show:

- Both full-service and limited-service diners cite cleanliness as the most important factor—73% of QSR customers put it in their top three considerations.

- While price still matters, 47% of QSR customers say a good experience is more important than the meal’s cost, especially true for Gen Z, where 58% prioritize experience.

- 54% of QSR customers prefer to dine at restaurants where they’re members of a loyalty program. 71% of QSR operators report that loyalty programs helped increase traffic in 2024.

Key Takeaways for Consumer Trends

- Experience quality, not just price, increasingly drives loyalty.

- Loyalty programs and discounts play a critical role in QSR customer retention.

- Health-conscious menus, faster service, and cleaner environments will define quick-service restaurant trends.

Industry Statistics: Technology & Innovation

Looking beyond 2025, technology and innovation in the quick-service restaurant industry are increasingly important:

- A majority of customers want tech-enabled ordering and payment options, especially for limited-service dining. This includes apps, kiosks, and real-time value alerts.

- 86% of consumers say they would take advantage of just-in-time promotions delivered via mobile or digital platforms.

Key Takeaways for Technology

- Digital engagement is crucial to driving QSR traffic in 2025.

- Mobile apps and loyalty integrations offer real ROI for operators.

- Innovative formats like meal kits and subscription bundles are rising.

Conclusion

The quick service restaurant industry remains a dominant force in U.S. food service, driven by shifting consumer preferences and strong market fundamentals.

Operators who prioritize value, speed, cleanliness, and loyalty-driven incentives are well-positioned to thrive in an increasingly competitive market.

Is Rezku the POS system you’ve been searching for?

Get a custom quote and start your free trial today.

Related Posts